General Investment Approach

Juniper’s investment approach is distinct from those of other private equity firms in terms of our long-term investment horizon, the team’s significant industry and operating experience, and our strict focus on the power and importance of human relationships.

Target Industries

- Business services

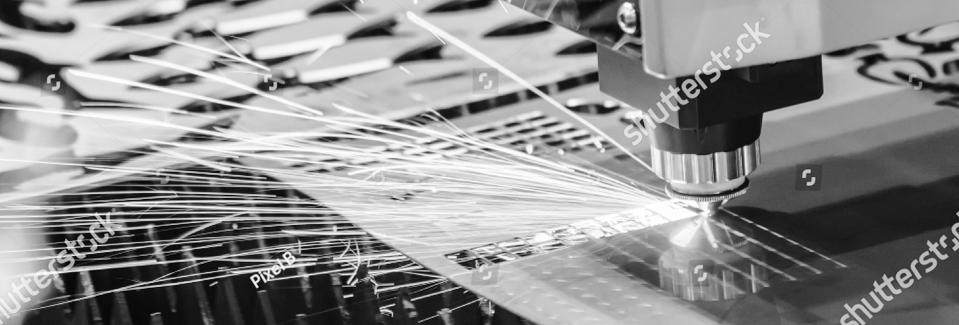

- Niche + value-added manufacturing

- Industrial products / services

- Infrastructure services

Select Target Subsectors

- Digital water services

- Environmental remediation

- Facility testing, inspection and monitoring

- Food + safety testing

- Fire protection inspection, testing and monitoring

- Manufacturing of water, urethane and epoxy-based adhesives and sealants

- Plastics + packaging

- Refrigerated warehousing / storage + supporting technologies

- Remediation + waste management disposal

- Specialty construction coatings

- Value-added manufacturing of specialty engineered aerospace hardware

Target Investment Criteria

While each investment opportunity is considered on its own merits, we generally look for companies that fit the following criteria:

- U.S.-headquartered portfolio companies, preference for the Southwest and Midwest

- $10 million – $100 million in revenue

- Trailing 12-month EBITDA of $5 million+

- Proven management team desiring a significant equity stake

- Three years of positive EBITDA with predictable continuation

- Diversification of customers, product / service lines and channels